Чехия – 2010 – Сельское хозяйство

Чехія – 2010 – Сільське господарство (анг.)

Improving Situation of Czech Agriculture

Tomáš Doucha, Institute of Agricultural Economics and Information, e-mail: doucha.tomas@uzei.cz, www.uzei.cz

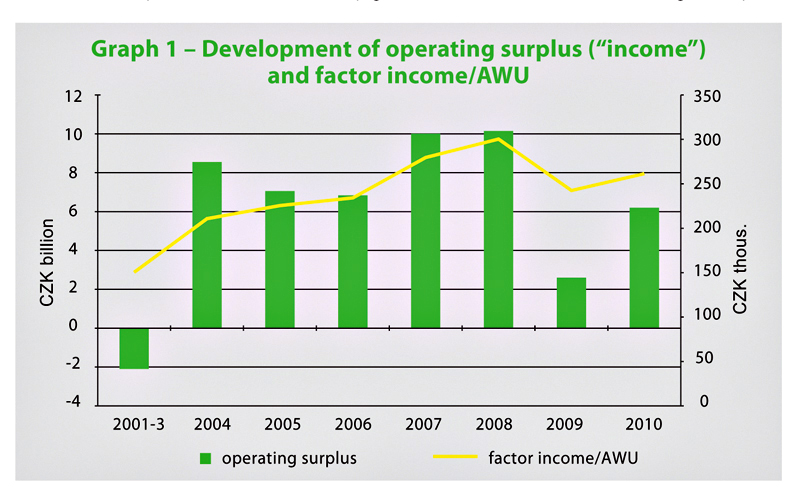

Following the accession of the CR to the EU, the economic situation of Czech agriculture has improved significantly, despite fluctuations in individual years. According to data from the Czech Statistical Office, the overall business revenue (“income”) of the field saw a 2.5-fold year-on-year increase to CZK 6.2 milliard (approx. EUR 248 million).

During the seven years after the CR’s accession to the EU, the overall accumulated income reached approximately CZK 52 milliard (approx. EUR 2.08 milliard), i.e. about CZK 7.4 milliard (approx. EUR 296 million) on average per year, whereas the average for the three years before the accession was CZK -2.1 milliard (approx. EUR -84 million). Factor income (i.e. net added value, including subsidies, excluding production taxes) per one work unit, i.e. resources for the reimbursement of work costs, rent and interest, saw a year-on-year increase of 7.8% to CZK 261 500 (approx. EUR 10 460) in 2010. The highest factor income per employee (over CZK 600 000 in 2009 – approx. EUR 24 000) tends to occur, in the long-term, in big enterprises oriented at plant production and especially enterprises located in less favourable natural conditions with very extensive beef raising on perennial grasses. These enterprises have a very low employment rate (roughly 1.4–1.7 employees per 100 hectares). Conversely, the lowest factor income per employee, in the long-term, occurs in enterprises oriented towards pig and poultry farming (approx. CZK 150 000 in 2009 – approx. EUR 6 000).

Subsidies contribute to factor income in the CR by approximately 70% which makes Czech agriculture one of the most subsidised in EU countries. This indicates an extraordinary dependence and sensitivity of Czech enterprises to subsidies, which allow even less efficient enterprises to survive. Czech agriculture as a whole is incapable of covering its costs without subsidies; it would be unprofitable. The share of intermediate consumption (variable costs) in overall production may have been decreasing, but the current share of 77% is still disproportionately high when compared to the majority of EU 15 countries. This indicates a less efficient utilisation of production resources which results in approximately half nominal factor income per employee.

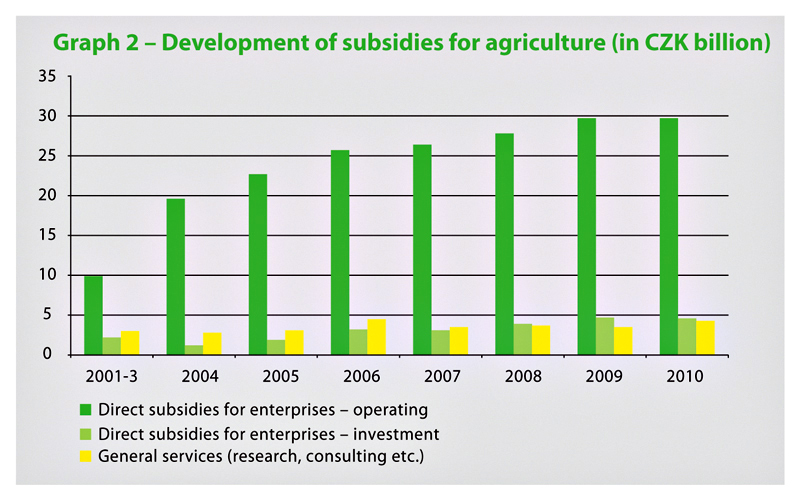

Growing Share of Investment Subsidies, Declining Numbers of Employees

Subsidies for agricultural enterprises (excluding the so-called general services – research, consulting etc.) have grown, in comparison to the period before the accession, almost 3-fold and currently amount to approximately CZK 9 600 (approx. EUR 384) per hectare, or CZK 260 000 (approx. EUR 10 400) per employee. The greater part (66%) is covered from EU funds, and more than 50% is intended for increasing enterprise income. The growing share of investment subsidies for the modernisation of agriculture is a positive development.

We are observing a constant, gradual decline in the number of agricultural employees. In 2010, the number of work units was 114 200 (year-on-year decrease of 5%), whereas during the period of 2001–3, it was on average 154 600 and 530 000 in 1989. The decline in the number of employees, coupled with the improved economic situation of enterprises, is reflected in growing wages in agriculture, despite the fact that the average wage in this field is well below the national level. In 2010, the average wage in the field amounted to CZK 18 644 (approx. EUR 746), i.e. 77.8% of the average wage in the national economy.

“The price scissors” for agriculture closed slightly in 2010 when compared to the year before. A year-on-year comparison shows an overall growth of the price index of agricultural producers (PIAP) by 5.4% (while the consumer price index only grew by 1.5%), and the prices of entry into agriculture went down by 1.8%. However, in the long-term, the price scissors have been opening since 2003. Pressures for lowering the PIAP are also the result of the lower efficacy of the domestic food-processing industry, especially in the segment of primary processing of agricultural raw materials. In 2006, the Czech agricultural industry achieved about 40% productivity when compared to the average in EU 15 countries.

Impact of Economic and Market Conditions on Production Structures in Agriculture

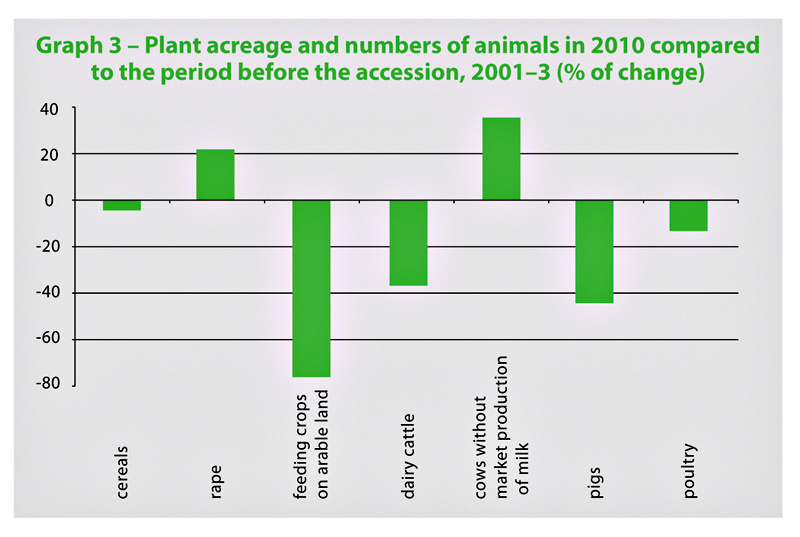

The listed economic and market conditions are reflected in changes to the production structure of Czech agriculture, which also result from the adaptation of Czech agriculturalists to these conditions. The annual value of agricultural production (in common prices) has been fluctuating between 93 and 105 milliard CZK (approx. EUR 3.7–4.2 milliard) since 2003, with the share of plant production growing: while the ratio of plant to animal production was 50.3% to 49.7% in 2001–3, it was 56.9% to 45.1% in 2010.

The changes in plant production after 2003 have been mostly caused by higher production of cereals and rape; the economy of this field has been helped by the growing demand for bio-fuels. Conversely, due to the decline in the numbers of animals, we’re seeing a significant decrease in the acreage of feeding crops which creates a structural imbalance in the use of land and other factors which is in turn balanced by the energy use of biomass (e.g. in the growing number of agricultural bio-gas stations).

In the area of animal production, there has been a continuing decline in the number of dairy cattle (35% less in 2010 than before the accession) which has been accompanied by increases in its use value. However, the decline in the number of dairy cattle has also been accompanied by a continuing increase in the numbers of cows without any market production of milk (35% more in 2010 than in 2003). There has been an enormous decline in the number of pigs (of almost 45% when compared to the period before the accession) and consequently in the production of pork (of more than 37% when compared to the period before the accession). A similar, albeit more moderate, trend can be seen in the number of poultry and in the production of poultry meat.

The listed trends correspond with the differences in the overall cost-effectiveness of commodities. The significantly favourable cost-effectiveness of main plant commodities (e.g. 26% for food wheat and 17.7% for rape in 2009/10) is in contrast with the loss-making of the majority of animal production commodities (e.g. -20.2% for pigs, -2.8% for poultry, 8.6% for fatstock in general in 2010). Conversely, thanks to the growth of the PIAP, the cost-effectiveness of milk production improved significantly in 2010; from a loss of -11.2% in 2009 to a positive 9.4% in 2010. Extensive beef raising with cows without market production of milk is also very profitable with the given subsidies.

Compared to farms in more developed countries of the EU, the cost-effectiveness of main commodities, while allowing for all costs, is relatively favourable (with the exception of, for example, pigs, poultry or beef-cattle feeding). It is a consequence of, among other things, the currently low price of work and land in the CR. The main causes of problems in animal production include lower productivity of work and use of feedstuff, and lower use value, i.e. worse production parameters.

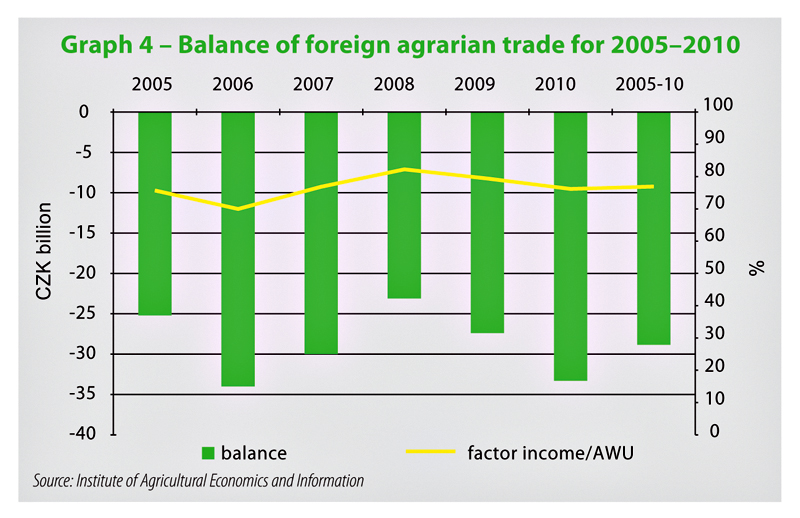

Foreign Agrarian Trade

The Czech foreign agrarian trade is characteristic for its year-on-year increases of negative balance accompanied by growing turnover, increasing share of raw material export (cereals, rape, live animals, milk) and growing import of processed products. The trade deficit further increased to CZK 33.2 milliard (approx. EUR 1.3 milliard) in 2010. Import of processed products has been growing in the long-term, especially in the area of meat and meat products. Traditional export products (beer, malt, hops) suffered a year-on-year decrease of export in 2010. The trade balance is significantly influenced by the aforementioned lower efficacy of the Czech food-processing industry.

Czech Agriculture and Natural Environment

Following the year 2004, we saw a stagnation or just a slight improvement in the relations of agriculture towards the natural environment. Despite significant stimuli and stricter conditions for the provision of subsidies, problems in this area have not been eliminated. These are mainly problems related to water and wind erosion, relations of agriculture towards the water regime and protection of biodiversity. The ratio of perennial grass greens to the rest of agricultural land is still high (around 27%) and does not correspond with the natural and climatic conditions of the CR. One positive thing is the growth of the share of ecological agriculture on agricultural land (10.6% in 2010). However, it is still totally dominated by low production of extensive agriculture on perennial grass greens.

Future Challenges

The prevalent production force in the Czech agriculture is big enterprises (the average Czech farm is approximately 7 times as large as the average in EU 25). However, agriculture has only a small share of high added value sectors (vegetables, fruits, flowers, wine etc.) and a low effectiveness of animal production, i.e. sectors with more exacting requirements for the quality of management, work and technological facilities. Compared to the more developed countries of the EU, our agriculture shows an above-average ratio of costs for a relatively low production per hectare, and the CR is thus a country with a costly extensive production. The currently low prices of work and land create a temporary competitive advantage for the Czech agriculture, but the rising prices of these factors, without an increase in effectiveness of their use, represent a significant risk for the Czech agriculture in the future. On top of that, the high ratio of hired work and land increase the sensitivity of Czech enterprises to the ever fiercer market fluctuations which, to a certain measure, lessens the advantage gained by the size of the enterprises.

Supplemet of Czech Business and Trade 4/2011

Source: doingbusiness.cz

|