Чехия – 2010 – Литейная промышленность

Чехія – 2010 – Ливарна промисловість (анг.)

Prospects of the Foundry Industry and Metallurgy in the Czech Republic

Jiří Braňka, National Observatory of Employment and Training, National Education Fund, e-mail: branka@nvf.cz,www.budoucnostprofesi.cz

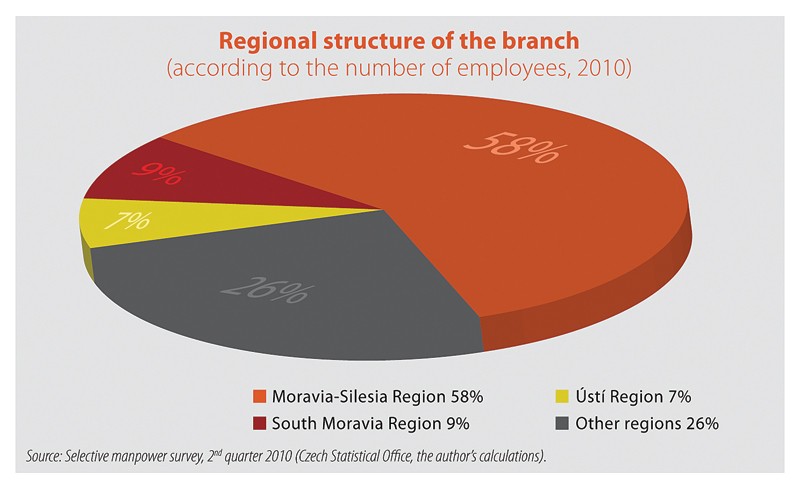

Metallurgy and the foundry industry were among the economic pillars of the former socialist Czechoslovakia. In the course of the country’s transformation, however, they lost most of their original facilities and workplaces. From the production and employment points of view, they are a branch strongly concentrated in the Moravia-Silesia Region. For example in 2009, the region accounted for 58% of jobs in the sector nation-wide.

In the past, the main problem of the sector was its low productivity of labour combined with inadequate technological standards. In 2001, the productivity of labour in Czech enterprises was approximately 20% of the EU average. The arrival of foreign investors in the branch triggered off important changes, which in six years led to a rapid growth in production (by 75%). Simultaneously, restructuring and technological investments made it possible to decrease the number of jobs by more than one-fifth. The sector’s development was pushed forward by high demand of the customer segments in the entire EU – metal-working, engineering, automotive industry, construction, etc. In spite of this, the share of the branch in overall manufacturing industry output between 1998 and 2008 dropped from 8.8% to 6.5%.

After six years of continuous growth (2003-2008), in 2009 Czech metallurgical and foundry industry production plummeted by more than one-quarter. In terms of the volume of production the branch returned to the 2004 level as a result of the economic crisis. The marked recovery in 2010 (e.g. the Ferrous Metallurgy Union forecasts up to 15-20% growth1) of commodity output year-on-year) will wipe off only a part of the sector’s loss, and it will take at least two years to raise the volume of output to the 2008 level, the highest to be recorded so far. Today, the branch is profiting from the renewed demand of customer segments; long-term prospects in the Czech Republic, however, will also depend on the specific conditions for doing business (especially legislation, the situation on the labour market and availability of skilled workers) and the competitiveness of enterprises in the Czech Republic in comparison with other countries (also with regard to technological standards and productivity of labour).

Conditions for Doing Business

The conditions for doing business will pose a great challenge in the next few years. The Moravia-Silesia Region, where the major part of production facilities is located, is suffering from long-term exposure to heavy air pollution, and companies such as ArcelorMittal, Třinecké železárny, and Vítkovice Steel are under pressure to invest in costly equipment to decrease emissions. The continuous stiffening of environmental legislation, however, will affect all EU member states. A certain problem on the labour market is the availability of skilled workers for metallurgical and foundry production, as young people are increasingly shunning this profession. In recent years, however, regional authorities and companies have been taking steps to attract more trainees.

Competitiveness of the Branch

The competitiveness potential of the branch can be measured by its innovative activity, technological standards, research and development promotion, and the qualification structure. Czech metallurgical and metal-casting enterprises will have to invest more in the next few years to maintain their lead over their rivals in cheaper countries. In view of the expected development of input prices, this will involve, for example, projects focusing on higher material and energy efficiency and technologically more demanding products requiring higher skills.

Expectations in the Branch

The development in customer branches is rather uncertain. Metallurgy and the foundry industry in the Czech Republic will continue to benefit from the concentration of customers in the vicinity of the main production localities (e.g. the North Moravia – West/North-West Slovakia automotive cluster). On the other hand, the production capacity of the car industry and engineering in Western Europe is often judged as excessive, as the growth potential of the West European markets is very small. On the other hand, the developing economies of Eastern Europe and Asia are offering great opportunities. Czech metallurgy and metal-casting, however, are not as yet in a position to take full advantage of it. Construction is recovering from the crisis only very slowly and the restoration of investment confidence in this branch may take more than a year – especially in a situation of uncertainty as regards the further development of the European economy and concern provoked by the situation in the area of public financing in several eurozone countries. Demand in the construction sector, however, has had good prospects on a long-term basis, and in Central and Eastern Europe this sector still has a great potential.

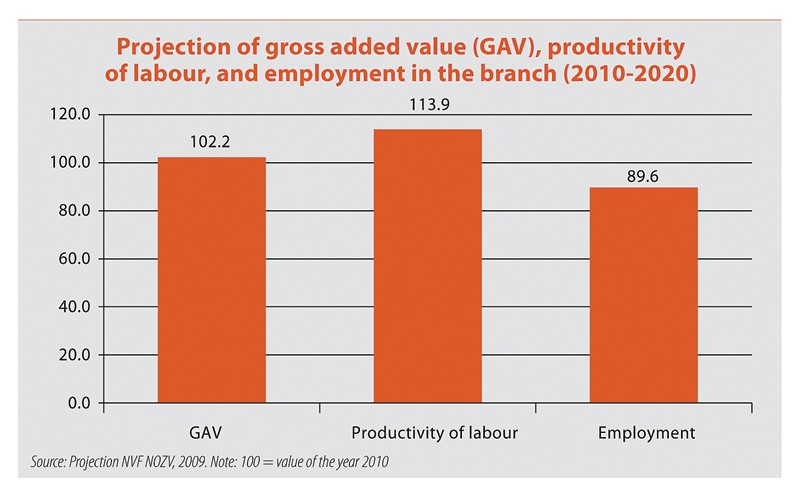

In the next few years, metallurgy and the foundry industry will be facing new conditions that will strongly influence their long-term prospects in the Czech Republic. As industrial and building production will continue to be among the pillars of the country’s economic growth, it is to be expected that the importance of metallurgy and metal-casting in the structure of the Czech manufacturing industry will decline only slowly. Production in the branch will continue to grow slightly despite the declining number of employees. This will be made possible by higher productivity of labour, so that Czech metallurgy and metal-casting will continue on their way to getting ever closer to the advanced West European countries.

1) “Prediction of the development of the steel industry”, Ferrous Metallurgy Union

Supplement of Czech Business and Trade 1-2/2011

Source: doingbusiness.cz

|